Content

SEC regulations do not require a trade to be executed within a set period of time. But if firms advertise their speed of execution, they must not exaggerate or fail to tell investors about the possibility of significant delays. Unusual options activity occurs when trading volume in an options contract is high above its average.

Most stock exchanges operate on a „matched bargain“ or „order driven“ basis. When a buyer’s bid price meets a seller’s offer price or vice versa, the stock exchange’s matching system decides that a deal has been executed. In such a system, there may be no designated or official market makers, but market makers nevertheless exist. A market maker is an individual or broker-dealer that operates on a stock exchange, buying and selling shares for their own account. Market makers earn a profit both from collecting the spread between the bid and ask prices of a security and also from holding inventory of shares throughout the trading day. Full-service brokers provide their clients with more value-added services.

Trading Instruments

And, if there wasn’t one, the specialist would buy or sell the stock themselves out of their own inventory. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day Trading is a high risk activity and can result in the loss of your entire investment.

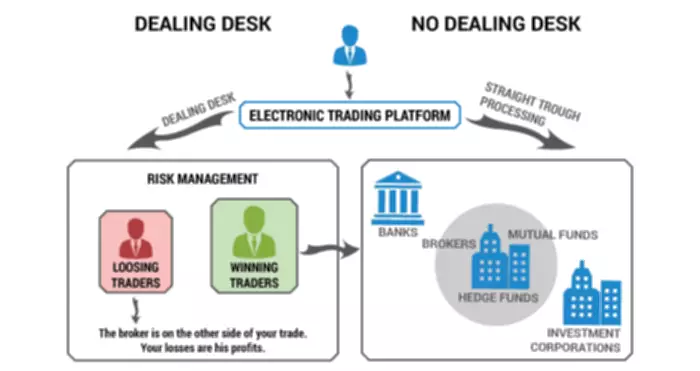

Let’s also mention the fact that by forming a counterparty to your trades on their side, these brokers potentially have the motivation to manipulate the market to their advantage. So as a trader, you logically have to wonder whether a broker who has such tools in his hand is not abusing them to enrich himself at your expense. Spreads directly from our liquidity providers + direct access to the interbank market. You will receive the standard ECN account automatically once you have opened a real account with us. Market makers earn money on the bid-ask spread because they transact so much volume.

What Entities Act as Market Makers?

This type of activity is often due to institutional investors and it can be a signal that smart money thinks the price of a stock will move soon. Usually, a market maker will find that there is a drop in the value of a stock before it is sold to a buyer but after it’s been purchased from the seller. As such, market makers are compensated for the risk they undertake while holding the securities. When they participate in the market for their own account, it is known as a principal trade. When a principal trade is made, it is done at the prices that are displayed at the exchange’s trading system. A bid-ask spread is the difference between the amounts of the ask price and bid price, respectively.

If a market maker wants to push down a stock price, then they take the risk of getting squeezed and vice versa. However, if a market maker has an institutional order to sell 1,000,000 shares of XYZ, chances are it will make a negative material impact on the share price. The market maker would “work” the order by shorting stock in the open market and close out the trade by purchasing the institutional order. Market makers are allowed to make agency trades and principle trades so if they short an additional 50,000 shares knowing they can drive down the price to cover, it’s doable and not illegal. Unlike dealing desk brokers, they send trading orders to liquidity providers, including banks, and hedge and mutual funds. The most common example of a market maker is a brokerage firm that provides purchase and sale-related solutions for real estate investors.

Because market makers are taking the opposite side of their client’s trades it adds a great deal of liquidity. It can also assure traders that they get filled quickly when placing trades. Market makers also set their own spreads, and because competition in this space is so fierce these spreads are often very good. The market making broker also provides trading software to clients free of charge, and often their price movements aren’t as volatile as the prices quoted on ECN or STP networks.

Of course, the additional time it takes some markets to execute orders may result in your getting a worse price than the current quote – especially in a fast-moving market. Unofficial market makers are free to operate on order driven markets or, indeed, on the LSE. They do not have the obligation to always be making a two-way price, but they do not have the advantage that everyone must deal with them either. Technical indicators play an important role in trading, and particularly in day trading. Indicators provide deeper insight into price movements and give traders the information they need to identify potential setups and make trading decisions.

What is a Market Maker?

The deal, therefore, remained open until the system found a seller ready to sell 8 shares of Apple stocks. The purpose of a market maker in a financial market is to keep up the functionality of the market by infusing liquidity. Market maker refers to a company or an individual that engages in two-sided markets of a given security. They profit from the bid-ask spread, and they benefit the market by adding liquidity. Market makers can either be individuals or broker-dealers who meet a certain set of requirements around education, training, capital adequacy, and so on. Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice.

A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. A bond broker is a broker who executes over-the-counter bond trades on behalf of investors . Sometimes a market maker is also a broker, which can create an incentive for a broker to recommend securities for which the firm also makes a market. Investors should thus perform due diligence to make sure that there is a clear separation between a broker and a market maker. The bid price is the price that they’re willing to pay for your shares, while the ask price is the price that they will sell them. Compare selected brokers by their fees, minimum deposit, withdrawal, account opening and other areas.

In the US, market makers are mandated to execute securities at, or better than, the national best bid offer price . When your order is executed at a better price, it’s called a price improvement. This NBBO is a reference to the prices on public exchanges and we can interpret the price improvement as the amount better than you would get if your order is executed on an exchange. Most foreign exchange trading firms are market makers, as are many banks.

What Is a Market Maker?

When an entity is willing to buy or sell shares at any time, it adds a lot of risk to that institution’s operations. For example, a market maker could buy your shares of common stock in XYZ just before XYZ’s stock price begins to fall. The market maker could fail to find a willing buyer, and, therefore, they would take a loss. They earn their compensation by maintaining a spread on each stock they cover.

- There are a wide range of market makers from big banks and institutions down to specialized shops and individuals.

- Using a direct market access broker to control your order routing ensures that market makers won’t take the other side of your trades.

- It, however, represents a conflict of interest because brokers may be incentivized to recommend securities that make the market to their clients.

- It should be noted that brokers use different infrastructure configurations to execute transactions.

- Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade.

- Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange or the London Stock Exchange , are called „third market makers“.

They will typically offer very competitive spreads since they are getting pricing directly from the interbank market. They also offer almost no chance of price manipulation because they never take the other side of their client’s trades. STP brokers are also the most likely to offer no requites and positive slippage, or better prices than what you’re quoted. Finally, the STP brokers typically have no restrictions on scalping, hedging, news trading, and high-frequency trading.

They offer narrower bid-ask spreads but at a higher and fixed commission. These brokers provide trade orders directly to the ECN, sending them to securities market intermediaries. An SEC presentation highlighted one example where market makers control the float of a company and then adjust prices arbitrarily to their own benefit as a type of market manipulation. However, the act of market making itself is fine as long as participants stay within the rules and regulations of the SEC and stock exchanges. A market marker is an individual or broker-dealer that has registered with an exchange to buy and sell shares of given stocks directly from other market participants. Financial exchanges rely on market makers to provide orderly trading of the underlying stocks, options, and other products listed on their platforms.

How Do Market Makers Earn a Profit?

Each market maker displays buy and sell quotations for a guaranteed number of shares. Once the market maker receives an order from a buyer, they immediately sell off their position of shares from their own inventory. In short, market making facilitates a smoother flow of financial markets by making it easier for investors and traders to buy and sell. Without market making, there may be insufficient transactions and fewer investment activities. Electronic communications networks are the primary competitors to market makers.

Trades attract commissions on both sides of the trade (i.e. entry and exit). Market makers must operate under a given exchange’s bylaws, which are approved by a country’s securities regulator, such as the Securities and Exchange Commission . The offers https://xcritical.com/ that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Brokers have an obligation to act in the best interests of their clients.

How can I become a market maker?

Brokers are intermediaries who have the authorization and expertise to buy securities on an investor’s behalf. Unsurprisingly, these firms are often also the ones that have the highest PFOF revenues, with Robinhood receiving half a million dollars in PFOF in the period analyzed. Fees, minimum deposit requirements, withdrawal, account opening, research tools and more. We use over 50,000+ data points and a consistent, fact-based methodology. Answer a few simple questions and get a list of the most relevant brokers.

MFT – multilateral trading facility – a type of exchange on which different participants are linked together. It should be noted that brokers use different infrastructure configurations to execute transactions. Market makers are essential to make sure the financial markets run smoothly and fill market orders of all sizes. Crypto Assets See our spotlight page to expand your knowledge and understand the risks of investing in crypto assets. We offer a large range of products and services to enhance your business operations. These two Forex brokerage models are referred to as A-book and B-book processing.

However, small spreads, as such, can add up to large profits on a daily basis, owing to large volumes of trade. Without market makers, far fewer trades would happen, and companies would have more limited access to capital. The speed and simplicity with which stocks are bought and sold can be taken for granted, market maker crm especially in the era of app investing. It takes just a few taps to place an order with your brokerage firm, and depending on the type of order, it can be executed within seconds. In times of volatility, the relatively stable demand of market makers keeps the buying-and-selling process moving.

Broker-dealers with institutional clientele like Goldman Sachs, JPMorgan and Morgan Stanley specialize in institutional market making as well as retail client orders. Wholesalers have order flow arrangements with various broker-dealers as well as fintech trading apps. Some of the largest wholesalers include G1 Executions Services, Apex Clearing Corporation, Citadel Securities, Virtu Financial and Two Sigma Securities.