Contents:

There are no contracts, so you can change your plan or cancel at any time. And, as they point out, you can deduct accounting fees on your annual return, so that’s an extra little incentive. We use dedicated people and clever technology to safeguard our platform.

PTC independent director quits over governance issues Mint – Mint

PTC independent director quits over governance issues Mint.

Posted: Fri, 21 Jan 2022 08:00:00 GMT [source]

WePay accepts Visa, MasterCard, American Express, Discover, and ACH transfers. Spark can also collect details from connected bank accounts, credit cards, and third-party processors like PayPal and Square. This eliminates costly and error-prone manual accounting. Botkeeper has built a full suite of tools, letting CPA firms and/or business owners pick the tools that work best for them.

Add-ons and Integrations

That all starts with the real-time accounting dashboard, which you’ll be presented with whenever you log into Spark. As one of the ‘Big 4’ global accounting firms, KPMG specializes in tax compliance. Spark is the platform through which it helps SMBs and startups stay tax compliant. Spark lets you connect to your bank accounts for the purposes of paying bills. Your dedicated bookkeeper prepares monthly profit & loss and income statements.

- Akounto, a cloud-based accounting software and bookkeeping software, is designed to help businesses streamline and manage their financial data.

- I also love that i’m able to send invoices to my clients, and that they can pay online.

- Akounto is a cloud-based accounting and bookkeeping software designed to help businesses manage and streamline their financial data.

- IDOS allows for real-time, accurate transaction processing.

KPMG Spark is an online bookkeeping service helping small to medium-sized businesses manage their day-to-day bookkeeping and finances. Being a new small business and having a full time job, I did not have the time to figure out the proper accounting and bookkeeping skills. Using Bookly helped reduce the work and stress of tracking every transaction. They are also helping me out on my taxes which is another huge burden gone!

Overall Rating

Cloud-based suite of software to streamline entire business flow. A single platform with multiple powerful software facilities. Create financial transactions & streamlined reporting using this book-keeping app. Point-of-sale software with innovative tools to operate and enhance productivity of every business type.

AccountEdge provides full-featured accounting software to small businesses, available on the desktop in the United States or Canada. We offer upgrades at a discount each year, but it’s always your decision. The customer support of KPMG Spark is closely tied with the dedicated bookkeeper that each client receives upon signup. Apparently, the brand doesn’t see the need to provide classic customer support via a call center when everyone gets their own, personal assistant on the team. For the pre-sign up phase, however, the company does offer instant live chat, FAQs, and phone assistance. Dedicated Bookkeeper – Every client is granted the services of a dedicated bookkeeper upon signup.

Auditors call council’s billion pound property „roulette“ into question – The Bureau of Investigative Journalism

Auditors call council’s billion pound property „roulette“ into question.

Posted: Sat, 27 Apr 2019 07:00:00 GMT [source]

This acquisition expands Decimal’s offering, giving us a solution and an integrated ledger for smaller businesses. Once you’re all set up, you’ll be able to update and categorize your transactions in real-time. From here, you can leave the day-to-day bookkeeping tasks to your bookkeeper. You can run reports yourself to check your financials at any time. When you sign up for one of their plans, a member of their team will help you integrate your bank accounts into their software. You’ll also be introduced to the bookkeeper that’ll be handling your account.

Login to the Core Client Portal

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Also displayed are several informative charts including a timeline of expenditure, revenue, and net profit over the past year. Below your annual breakdown chart, you’ll find a summary of monthly expenses. When it comes to usability, KPMG Spark really comes into its own.

Cemex CDS payments sparked by debt reorg – ISDA – Reuters.com

Cemex CDS payments sparked by debt reorg – ISDA.

Posted: Mon, 14 Dec 2009 08:00:00 GMT [source]

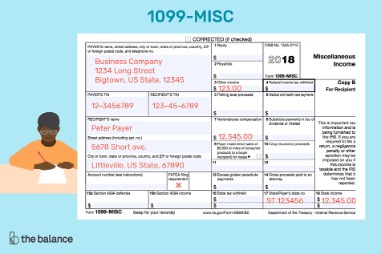

Your subscription will cover access to core features of the KPMG Spark platform, but a few extra add-ons are also available. These include an income tax preparation package at $125 per month and a business licensing service starting at $20 per month. You can also buy a one-time R&D credit feasibility study for $500. Wave’s simple-to-use accounting program can connect to your bank accounts, sync expenses, balance your books and prepare you for tax time.

KPMG Spark Features and Options

To connect KPMG Spark with more than 10 accounts, you’ll need to request a custom pricing quote. Alternatively, your clients will have the option to submit payment directly through Spark using WePay, a California-based online payment provider owned by JPMorgan Chase. WePay is best known for its partnerships with crowdfunding sites like GoFundMe. When a client pays through WePay, they will be able to make use of MasterCard, American Express, Visa or Discover. Digital CFO is an automated accounting software ERP that allows financial management and reporting. It is not dependent on the size or sector of the business.

Also, you can accept online payments via Visa, MasterCard, American Express, and Discover with low fees of 2.9% + 55¢ per invoice. Those prices represent the cost of KPMG Spark if you pay in advance for a year’s worth of service. If you’d rather pay month-to-month, costs jump by approximately 10%. Top10.com’s editorial staff is a professional team of editors and writers with dozens of years of experience covering consumer, financial and business products and services. With KPMG Spark, you can access your account to view or export real-time data at any time. At month’s end you’ll receive a notification that your financial statements are ready to view or export.

A core KPMG Spark feature is an advanced invoicing system that enables you to produce professional templates almost instantly and accept payment from your clients. Spark can collect payment details from recipients and lets them pay you directly via the WePay platform. The other notable thing about the Spark platform is the hands-on service. When you enter your dashboard, you’ll find your bookkeeper’s and account manager’s contact details clearly displayed on the right-hand side of the screen. They may also contact you if something in your data needs clarification.

This website is an informative comparison site that aims to offer its users find helpful information regarding the products and offers that will be suitable for their needs. We are able to maintain a free, high-quality service by receiving advertising fees from the brands and service providers we review on this website . In the event rating or scoring are assigned by us, they are based on the position in the comparison table, or according to other formula in the event specifically detailed by us. See our How we Rate page and Terms of Use for information. We make the best efforts to keep the information up-to-date, however, an offer’s terms might change at any time. We do not compare or include all service providers, brands and offers available in the market.

Frequently Asked Questions (FAQs)

If they’re not available, you can discuss your tax and accounting issues with one of KPMG’s other expert employees. Spark’s proprietary technology lets you create professional invoices and get paid by credit card using WePay. KPMG Spark manages everything to do with accounting, tax preparation, and payroll. The top products based on usability and customer satisfaction, as rated by user reviews. Check out our full methodology description for more detail.

Access a head to head analysis of KPMG Spark vs alternative software solutions. Check out our in-depth review of FreshBooks, a cloud-hosted… The last thing worth mentioning is Spark’s support for multiple locations or projects.

Reproduction of this website, in whole or in part, is strictly prohibited. With industry-specific editions for manufacturing, distribution, construction, retail-commerce, and general bookkeepinges. With KPMG Spark you get an online bookkeeping solution that enables small business owners to handle accounts and track financials. Their services include audit, tax, and advisory services.

Veryfi is software that takes the work, error and frustration out of construction bookkeeping while enabling real-time field intelligence. Starting with automation of time & materials to digitize and end 90% of the time wasted doing it by hand and chasing records. We make the best effort to present up-to-date information; however, the terms of each offer can be revised according to the service provider’s discretion. The above shall not be considered as an expert or professional advice for any matter.

The period costs has exclusive partnership terms with WePay for handling payments and another partnership with Sure Payroll to take care of the payroll services. However, it can’t be easily integrated with any of the popular software like QuickBooks, Microsoft Office, PayPal, Slack, Shopify, etc. If such integrations are essential to you, you’ll need to speak with the brand to see if anything can be arranged. Note that such services will most likely come at an extra cost. Designed to help users make confident decisions online, this website contains information about a wide range of products and services.

As the name suggests, it’s a product of KPMG, one of the world’s leading audit and tax advisory firms. Online bookkeeping and tax accounting services for small to midsize businesses, start-ups, and non-profits. Their mantra is ‘Idea to IPO’ and they claim business owners can start with one accounting firm and stay with them through the whole tenure of running their business. The technology also learns more about your firm, and accuracy continues to improve. We extract data from receipts, process payroll, pay bills, send invoices, reconcile accounts, and generate beautiful reports. Is both a software and a service so they utilize their own system— the Spark platform.

If you have multiple locations/projects, these can be tracked individually and combined into a consolidated report. As for payroll, KPMG lets you pay employees using standard methods such as direct debit and check. The listings featured on this site are from companies from which this site receives compensation.

I would highly recommend Bookly for anyone spending time „working the books“ instead of other business activities. The blog is updated highly inconsistently and features topics related to taxation, bookkeeping, payroll, company culture, customer reviews of Spark, product updates, etc. Besides those invoicing fees, you’ll need to pay a monthly subscription to use KPMG Spark and prices vary based on the number of accounts you need bookkeeping for. This rises to $362 for 4 to 6 accounts, and $454 for up to 10 bookkeeping accounts. To help you get your books in order and simplify tax payments, KPMG Spark tracks and syncs expense information from across your business, displaying it all in one unified interface. What’s more, KPMG Spark has a variety of payroll organization tools to help you get prepared and pay local, state, and federal taxes.